As human beings, our brains contain psychological barriers that can stand between making smart financial decisions and poor ones. The good news is that once you realize your own mental weaknesses, it’s not impossible to overcome them. Here are nine of the biggest barriers…and some good strategies for fighting them:

Scenario 1: You’re about to buy an engagement ring so you do some research on prices. Most people say three months’ salary is the general budget, so you freak out and request a credit line increase.

What’s really going on: Anchoring.

Anchoring happens when we rely too heavily on the first piece of information offered when making decisions. After encountering the “three month” rule, you find it hard to make a logical decision based your own financial reality or your relationship. You may not have three months’ worth of salary to splurge on a diamond, but you decide to spend within that range because you are anchored to that idea.

Scenario 2: You’re 27 years old, in excellent health and just got promoted. You’re so high on life that you can’t fathom a time when you’ll no longer be young, fit, and financially stable.

What’s really happening: Myopia.

Because you are unable to picture yourself in old age, bad health, or cash-strapped, you’re less likely to save for unexpected events or your retirement. Myopia can be blamed for many depleted retirement savings accounts in the U.S. “Seduced by temporal myopia in their younger years, many people get around to saving seriously for their retirement far too late in their career, in their forties and fifties in many cases, which greatly reduces the amount of money they will have available for their retirement,” says Shlomo Benartzi, a behavioral finance economist and author of “Save More Tomorrow.”

If you’re lacking motivation, try this handy experiment: Use Merrill Edge’s Face Retirement generator, which will take a photo of you as you are today and generate an image of what you’ll look like in retirement. Benartzi’s own research has shown that this kind of reminder can actually give people the jumpstart they need to start saving for retirement.

Scenario 3: You’re watching the market closely and see that a certain stock has been tanking over the last few months. You give it another month, watch it drop again and decide to sell it off before history repeats itself.

What’s really going on: Gambler’s fallacy.

When investors rely on past events to predict the future, they’re shooting themselves in the foot. If a stock is flying or floundering for a year, that doesn’t mean it will continue to do so in the next year, or even in a few months to come. The same thing happens when you buy a lotto ticket because your buddy next door just won $10,000 in a drawing. Just because he won doesn’t change the odds of you winning at all.

Keep your decision-making grounded in the real facts. Analyze your investments before making any sudden moves or following trends.

Scenario 4: It’s open enrollment season for your company’s health care plan and the list of plans is so confusing that you put it off for days until, finally, the deadline rolls around. You give up, re-enrolling in whatever plan you already have.

What’s really going on: Avoidance.

This is a form of procrastination that could really cost you. There are a lot of meaty topics in finance, most of which are about as fun to research as it is to get a root canal. But if you miss a dentist appointment, you can easily reschedule. Mess up your health care election and you could be stuck with the wrong plan for an entire year and pay dearly for it.

Another area prime for avoidance: 401(k) plans. You know you’ve got to enroll so you just skip around until a decent plan name “speaks to you.” Not only could you have signed up for a plan with high fees or the wrong allocations for your risk tolerance, but you will only wind up paying more fees when you finally realize your mistake and have to switch plans.

In addition to a wealth of helpful tools and articles online, many retirement plan providers offer free advisors who are on call to help navigate you through the elections process. If they don’t, it could be worth it to book a one-time consult with a fee-only financial advisor.

Scenario 5: A tech company you love just went public and you’re dying to buy in. You decide to do your homework, but you skirt over the negative headlines, instead clicking on posts singing the company’s praises.

What’s really going on: Confirmation bias.

Investors aren’t machines. They’ve got feelings and like any normal human being, they can’t help but selectively filter out opinions that don’t mirror their own. In doing so, they create a false sense of security that can lead to some pretty boneheaded decisions.

If you want the full picture, you’ve got to seek out information that contradicts everything you thought you knew about a company before you can hope to form a balanced opinion.

Scenario 6: The stock market has just hit rock bottom, taking half of your retirement savings down with it. Shell-shocked and devastated by the loss, you demand that your financial advisor pulls every last investment out of the market immediately.

What’s really going on: Loss aversion.

Loss aversion plagues even the most experienced investors, making them avoid potential gains because they’re too afraid to take a risk.

Anyone who ditched the stock market for fear of further losses after the 2008 crash can blame loss aversion. The average pre-retiree 401(k) balance actually doubled since the recession. People who fled the stock market and never rebalanced their portfolios only rebounded by 25%.

Loss aversion can also have the opposite effect, causing investors to cling too tightly to losing investments. Because it hurts to admit that they picked a losing investment, they focus on selling off winners and hope they’ll rebound over time. If they aren’t careful, they wind up with a portfolio full of flops.

Scenario 7: You’re a savvy investor and you know you’ve got the goods to beat the market. So you jump in and start trading like a madman, trusting your gut and your own due diligence not to lead you astray.

What’s really happening: Overconfident investing.

It takes seriously overconfident investors to kid themselves into thinking they can beat the market when even the people whose full-time job is to beat the market fail so frequently.

Terrence Odean’s oft-mentioned study, “Trading is Hazardous to Your Wealth,” isn’t just a cute bedtime story for investors looking to stroke their egos. It actually shows that frequent trading caused by overconfidence can kill your returns.

Of more than 66,000 households using a large discount broker in the mid-1990s, those who traded most often (48 or more times a year) saw annual gains of 11.4 percent, while the market saw 17.9 percent gains, Odean found.

Scenario 8: You’re still working on building up your emergency fund and you just got a birthday check for $100. Instead of adding it to your savings account, you treat yourself to a new coat or a haircut.

What’s really going on: Mental accounting.

Mental accounting takes place when we assign different values to money depending on where we get it from. If you had earned that $100 by working overtime one week, chances are you’d treat it more like regular income and save it.

Mental accounting is a big reason why we spend more money with credit cards than using hard cash. It just feels “less” like money to us and therefore it’s much easier to spend.

Instead, repeat this mantra: “Money is money, no matter how I get it.” And the next time you use your credit card, ask yourself if you’d be spending that money if you were using cash instead. If the answer is no, hold off.

Scenario 9: A housing development in your county just went belly up and you’ve heard investors are snapping up cheap plots for a steal. You’ve got no experience flipping houses but you’re not about to miss out on a hot ticket like that.

What’s really going on: Herd mentality.

You’ve spotted a hot trend and you don’t want to be the only one out there who didn’t book a seat on the bandwagon. As human beings, it can be very uncomfortable standing still while the rest of our peers head the other way looking like they’re having a ball. It’s in our nature to want to join the party.

This causes a lot of problems when it comes to investing. If you’re willing to change course every time the herd moves, you’ll end up trading a lot more frequently and seeing your returns nibbled to bits by transaction costs alone, not to mention what will happen if the herd leads you astray.

Cotton on to a trend too late and you’ll just lose out when the herd moves on to hotter territory later on and your stock plummets. It’s just a vicious cycle that will only lead to selling low and buying high. The only way to profit from a trend is to get there before anyone else and the odds aren’t in your favor.

To set up a no-cost consultation with our Investment & Retirement Center located at First Financial to discuss your insurance and financial questions, call us at 732.312.1500 today!*

Article by Mandy Woodruff of Daily Finance.

*A First Financial membership is open to anyone who lives, works, worships or attends school in Monmouth or Ocean Counties. Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. First Financial Federal Credit Union (FFFCU) and First Financial Investment & Retirement Center are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using First Financial Investment & Retirement Center, and may also be employees of FFFCU. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of FFFCU or First Financial Investment & Retirement Center.

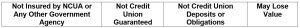

Securities and insurance offered through LPL or its affiliates are:

For many families, using an allowance to encourage children to do chores is an effective means of both teaching responsibility and money management. For other families, linking chores to an allowance means that the children only learn to help out around the house in exchange for payment. It is important for parents to sit down and talk about what they hope their children learn from the experience of getting an allowance. Here are three common methods you may wish to consider implementing:

For many families, using an allowance to encourage children to do chores is an effective means of both teaching responsibility and money management. For other families, linking chores to an allowance means that the children only learn to help out around the house in exchange for payment. It is important for parents to sit down and talk about what they hope their children learn from the experience of getting an allowance. Here are three common methods you may wish to consider implementing: