Are you considering a job change? If so, it is important to approach your job change with careful consideration.

Not only will a new role involve learning new skills, working with new people, and establishing a new routine, it will also require significant financial planning — at least in the transition period.

So, how can you set yourself up for success while transitioning to a new endeavor? By making sure your finances are in order.

5 Financial Tips to Remember When Considering a Job Change

Check your savings. If you already have another job lined up, your savings may only need to tie you over until your new paychecks start coming in. This might sound like a minor concern, but depending on the payroll schedule for your former company and your new employer, it’s entirely possible you could go a month or more between paychecks. If you’re leaving your job without another already lined up, you’ll need enough savings to cover expenses until you accept your next job offer. If you have the luxury of transitioning on your own time frame, aim to have several months’ worth of expenses in a savings account.

Trim your expenses. Admittedly, cutting expenses is never a fun topic of conversation. However, operating on a leaner budget (at least for a little while), can make your career transition far less stressful. So, before accepting a new job offer, take time to review your monthly budget and see if there are any belt-tightening adjustments you can make. Cut back on morning lattes, meal prep at home instead of buying lunch at a restaurant every day, or binge a Netflix series instead of going to a movie at the theater. You’ll be surprised how quickly little savings add up — and those savings can help you bridge the financial gap between jobs.

Review the compensation package. It’s natural to look at a job’s salary when trying to determine whether it’s a better opportunity. This is a good place to start, but there’s more to it than that. Does the prospective employer pay an hourly wage, salary, or combination of base plus commission? Do they cover a portion of employee insurance costs? Is the new employer’s paid time off plan equivalent to the one you’d be giving up? What about holidays? Be sure to compare the entire compensation package instead of just comparing the annual salary.

Account for relocation costs. If your new job will require you to relocate, it’s always a smart idea to look at the cost of living in your new location. A $10,000 per year raise is nice, but if you’re going to spend an additional $15,000 in housing expenses each year, the new job could cause you to fall behind financially. If you need help comparing living expenses, cost of living calculators can be extremely helpful. State income tax rates can be another location-dependent variable worth considering.

Don’t leave money behind. If your current employer offers a 401K or other retirement savings accounts, be sure to make arrangements to take those funds with you. This might seem like a no-brainer, but the fact that orphaned 401K accounts total an estimated $1 trillion – indicates it’s easier to overlook than you might think. When it comes to these employer-sponsored retirement plans, employees have three options when changing jobs: 1. Roll over funds to a 401K plan with the new employer, 2. Roll over the funds into an Individual Retirement Account (IRA), or 3. Withdraw the funds. It’s worth noting, however, that withdrawing the money usually incurs a steep penalty. To determine the best approach for your money, it’s always best to consult with a financial advisor. If you need a good place to start, check out the Investment and Retirement Center at First Financial.*

If you’re currently contemplating a job offer or thinking about what it would take for you to make a change, spend a little time crunching numbers. You can also contact your local credit union, and if you live, work, worship, attend school or volunteer in Monmouth or Ocean Counties in NJ – one of the financial representatives at First Financial FCU would be happy to help you make a financial plan. We can help you analyze your current finances, identify the best retirement rollover plans, and find ways to maximize your money in order to make your job change as smooth as possible.

*Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. First Financial Federal Credit Union (FFFCU) and First Financial Investment & Retirement Center are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using First Financial Investment & Retirement Center, and may also be employees of FFFCU. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of FFFCU or First Financial Investment & Retirement Center.

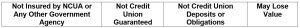

Securities and insurance offered through LPL or its affiliates are: