Autumn brings crisp air, changing leaves, and a desire to slow down and savor life’s little comforts. It’s also the perfect time to reconnect with your partner, and you can do that on a budget without ever leaving the house. At First Financial, we believe in building not just financial futures – but meaningful, shared moments. To help you lean into the warmth and creativity this season, here are 10 fall-friendly at-home date ideas that you and your partner will love.

Autumn brings crisp air, changing leaves, and a desire to slow down and savor life’s little comforts. It’s also the perfect time to reconnect with your partner, and you can do that on a budget without ever leaving the house. At First Financial, we believe in building not just financial futures – but meaningful, shared moments. To help you lean into the warmth and creativity this season, here are 10 fall-friendly at-home date ideas that you and your partner will love.

1. Create a Hot Chocolate & Dessert Bar

Transform your kitchen or dining room table into a cozy treat station. Offer various hot chocolate flavors (dark, milk, white, caramel, etc.), whipped cream, flavored syrups, cinnamon sticks, and marshmallows. Pair it with mini desserts like chocolate truffles, cookies, or slices of pumpkin pie. Put on soft music, and enjoy a sweet (literally) conversation.

2. Fall Baking Night

Gather seasonal recipes – think pumpkin bread, apple pie, or pecan cookies, and bake side by side. Work as a team: one mixes the dough, the other decorates or handles clean-up. When it’s ready, enjoy your creation over candlelight with a scoop of vanilla ice cream.

3. Indoor Picnic with a Twist

Lay out a cozy blanket in your living room. Prepare your favorite savory snacks (charcuterie board, grilled cheese, autumn soups) and add candles or string lights to set the mood. Bring in a playlist that reminds you of your earlier days together.

4. Craft Night

Get creative together. Some ideas might include:

- Making fall wreaths or garland

- Painting pumpkins

- Designing homemade candles with scents like cinnamon, apple, or pine

- Assembling a scrapbook or memory journal

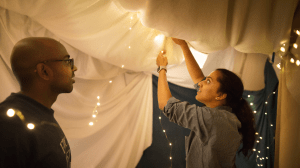

5. Movie Marathon Under a Blanket Fort

Build a cozy fort with blankets and pillows in your living room. Snuggle inside with popcorn and your favorite films or a series you’ve been meaning to watch together.

6. Wine or Cider Tasting

Select a few small bottles of wine or apple cider. Do a mini-tasting indoors, pairing each flavor with small bites like various cheeses, nuts, chocolate, or seasonal fruit. Discuss what you like (and don’t), comparing notes. Bonus points if you try local or regional refreshments.

7. Game Night or Trivia Duel

Dust off your board games or grab some puzzles. Compete in Scrabble, card games, or trivia challenges. Add a fall twist by including themed questions such as, which state produces the most apples? You can even create your own trivia quiz about you as a couple.

8. Read Aloud & Reflect

Pick a short story, poem, or favorite passage from a book and take turns reading aloud. After each reading, pause and reflect on what resonated. Keep things cozy with blankets, a soothing drink, and soft lamps.

9. Outdoor-Indoor Hybrid: Fire Pit & Stargazing

If you have a backyard or patio, light a small fire pit. Wrap yourselves in blankets, sip hot cider or cocoa, bring out blankets and pillows, and gaze at the night sky. You can transition inside later (maybe to that fort you built!) if the temperature drops.

10. Try a Virtual Cooking or Art Class

Sign up for a short online class – such as making pasta from scratch, painting a landscape, or learning to mix cocktails. You’ll follow along side by side, adapting to your pace. At the end, enjoy the fruit of your joint effort.

Final Tips for a Memorable Fall Date Night

- Set the atmosphere: Dim lights, candles, soft music.

- Unplug intentionally: Turn off or silence devices.

- Plan ahead: Pick the menu or craft materials in advance.

- Be flexible: Let the night evolve organically.

- Focus on connection, not perfection!

Fall is more than a season – it’s a mood, and a time to slow down and savor. Use these at-home date ideas as a canvas, then tailor them to your own taste as a couple.

Want more inspiration for living well and smart saving? Read more seasonal financial tips and ideas for staying within your budget on our First Scoop Blog!