There are thousands of savings tips that can help you grow your nest egg. Whether they involve brown-bagging it to work or using coupons at the supermarket, these are generally useful savings habits that can give you a leg up on ending each month in the black.

There are thousands of savings tips that can help you grow your nest egg. Whether they involve brown-bagging it to work or using coupons at the supermarket, these are generally useful savings habits that can give you a leg up on ending each month in the black.

But there are only a few super-sized savings rules that can truly transform your finances. Rules so big they deserve to be etched in stone. So, here are the “The Ten Commandments” of saving.

1. Thou Shalt Know Where Thy Money Goes

When generals go to war, they need an overview of the battlefield. Maps, exploration and data show them where the enemy is susceptible. In the battle for savings, the first thing you have to know is where your money is going.

Sites like Mint.com allow you to connect all your bank accounts, credit cards and loans to cloud-based software so you to track your finances on one screen, in real time, with just the click of a button. They also analyze your expenses and highlight areas where you might be wasting money. Best of all, it’s free.

2. Thou Shalt Eliminate Debt with Extreme Prejudice

Debt is bad, but it’s the interest on that debt that’s like kryptonite to your savings goals, and the sooner you eliminate it, the sooner you can become a savings Superman.

Moving debt from high-interest instruments, like credit cards, to lower-interest instruments, like a line of credit, is a start. Consolidation loans can be a help as well, but the easiest way to get out of debt fast is to take the interest expense you save and put it directly toward your debt’s principal amount.

First Financial’s Visa Platinum Cash Plus Credit Card has one of the lowest APRs around! It’s a good idea to check the APR on your current credit cards to see if it’s time to switch. You can apply for a balance transfer by stopping into any branch or by calling 732.312.1500, Option 4.*

3. Thou Shalt Read the Fine Print

Most people would be shocked at the amount of money that they waste on service charges, convenience fees and annual dues hidden in financial contracts. If that low-interest credit card charges you $99 annually no matter if you use it or not, is it really that great of a deal?

Make sure if you transfer a balance to a lower-interest credit card that there is not a transaction fee attached. And if you rarely or never use that credit card with the annual fee, think about applying for a card that better suits your financial well-being.

4. Thou Shalt Pay Attention to Timing

At the risk of sounding like a ’60s folk-rock star, to everything there is a season, and waiting for the right season to purchase big-ticket items can save you a bundle. For example, car dealers will discount their inventory when the new model year arrives to free up room on their lots, so If you are in the market for a new car, that’s the season to buy.

Many big-box retailers and department stores have semi-annual sales where you can pick up appliances, electronics and home goods at a discount. The key is to fight against the urge for instant gratification on your purchases.

5. Thou Shalt Keep an Eye on Interest Rates

Even if you are able to pay off your credit cards and loans, the one debt most people can’t pay off is their home mortgage, which is why you should watch interest rates. When interest rates move down, it can be an opportunity to refinance your home loan and save money on your monthly mortgage payment.

But remember, if you just take the money you save and spend it, you’re not saving at all. Earmark the difference between your new mortgage payment and your old one for your bank account, or if you plan to live in your home for the life of the loan, put the extra toward your principal and own your home sooner.

6. Thou Shalt Find Money in Thy House

Most people would be surprised to learn just how much money they have laying around their house. Those books you’ve already read can be sold on Cash4Books or Amazon.com, and your old phones and mobile devices can be sold to companies like Gazelle.

Cleaning out the clutter in your home doesn’t just feel good but provides you with an opportunity to feed your piggy bank by having a garage or yard sale. And what about those figurines you inherited or your comic book collection? Do you still really want them? If not, try listing them on eBay.

7. Thou Shalt Use Technology to Find Deals

The Internet makes saving money so easy that your grandmother would likely throw her coupon box at your head if she knew. Sites like Groupon and Living Social will send deals on goods and services in to your inbox, and apps like Out of Milk can alert you to store sales just by driving by them.

The Internet also is a great resource for finding free activities for you and your family to do on weekends, holidays and school breaks.

Subscribe to our First Scoop Blog and receive free, fun financial education straight to your inbox – at the beginning of each month we post a budget-friendly activity list for that month in Monmouth and Ocean Counties, NJ!

8. Thou Shalt Not Forget to Prioritize Your Retirement

This is a tough one, because it’s hard to save money now that you don’t expect to use for 30 or 40 years. But like it or not, there is going to come a time when your earning years are over and we will all need a retirement fund to bankroll the golden years. So if you don’t want yours to be bronze years, you have to make retirement saving a priority.

The good news is that you have many years to accumulate those funds and to let them grow, which means that small amounts of savings directed toward it can go a long way. For example, you can take a percentage out of every saved dollar, say 25 percent, and earmark it for your retirement. This is an easy and painless way to create both a short-term and long-term savings fund.

To set up a no-obligation appointment with our Investment & Retirement Center to go over your retirement and investment portfolio or to get started with one, call 732.312.1500 or email mary.laferriere@lpl.com or maureen.mcgreevy@lpl.com.**

9. Thou Shalt Not Try to Keep Up With the Joneses

A huge part of winning the saving game is changing your mindset about how you think of money and what its function is. Too often we get caught up in the game of keeping up with the Joneses and buy things we don’t really want — and certainly don’t need — just to keep up appearances.

What many people don’t take into account is that that boat, RV, ATV, third car or giant flat screen that their neighbor bought probably comes with a loan or a high-interest credit card payment. Before making that next impulsive purchase, ask yourself if you really want it and if it will bring you that same warm fuzzy feeling that a full savings account will.

10. Thou Shalt Act Like Thy Don’t Even Have It

We can’t spend what we don’t have, so the more you act like you don’t have it, the more you will be able to save it. Have retirement and college savings funds automatically deducted from your paycheck before you ever see it. Schedule a “secret” payment from your checking account to your savings account each week.

When you come across found money — like a rebate, an overpayment refund or even $20 in your pants pocket — just act like you never had it and put it right into your savings. With practice, you can get pretty good at this, so much so that if you have an unexpected windfall — say from an investment or an inheritance — you’ll forget it even happened. Only your savings account will know.

*APR varies up to 18% for purchases, when you open your account based on your credit worthiness. The APR is 18% APR for balance transfers and cash advances. APRs will vary with the market based on the Prime Rate. Subject to credit approval. Rates quoted assume excellent borrower credit history. Your actual APR may vary based on your state of residence, approved loan amount, applicable discounts and your credit history. No Annual Fee. Other fees that apply: Cash advance fee of $10 or 3% of the total cash advance amount—whichever is greater (no maximum), Balance transfer fee of $10 or 3% of the balance—whichever is greater (no maximum), Late Payment Fee of $29, $10 Card Replacement Fee, and Returned Payment Fee of $29. A First Financial membership is required to obtain a Visa® Credit Card and is available to anyone who lives, works, worships, or attends school in Monmouth or Ocean Counties.

**Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. First Financial Federal Credit Union (FFFCU) and First Financial Investment & Retirement Center are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using First Financial Investment & Retirement Center, and may also be employees of FFFCU. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of FFFCU or First Financial Investment & Retirement Center.

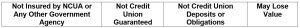

Securities and insurance offered through LPL or its affiliates are:

There are a lot of different kinds of credit out there. One of the most common forms is the auto loan. Though we are all itching to pay off our long-term debts and own something free and clear, there are a few precautions to know about before racing to get that statement to read zero.

There are a lot of different kinds of credit out there. One of the most common forms is the auto loan. Though we are all itching to pay off our long-term debts and own something free and clear, there are a few precautions to know about before racing to get that statement to read zero.

There’s really only one way to protect yourself from identity theft. Stop spending money and trust no one. It’s pretty easy.

There’s really only one way to protect yourself from identity theft. Stop spending money and trust no one. It’s pretty easy.

Nearly half of households in the United States are “liquid asset poor,” meaning they have less than three month’s worth of savings in the bank, according to a report this year from the Corporation for Enterprise Development, a nonprofit that tracks household financial security. Surprisingly, 25% of those who are considered “liquid asset poor” are in the middle class with earnings of $56,113 to $91,356 annually. What’s even more surprising is that 89% are employed.

Nearly half of households in the United States are “liquid asset poor,” meaning they have less than three month’s worth of savings in the bank, according to a report this year from the Corporation for Enterprise Development, a nonprofit that tracks household financial security. Surprisingly, 25% of those who are considered “liquid asset poor” are in the middle class with earnings of $56,113 to $91,356 annually. What’s even more surprising is that 89% are employed. Creating a budget is the first step in taking control of your finances. Sticking to your budget is another challenge altogether.

Creating a budget is the first step in taking control of your finances. Sticking to your budget is another challenge altogether.